“Work today as though you won’t receive a paycheck tomorrow. Because someday that will be true.”

Building wealth, viewed from a high level, is not very complicated. For most in the U.S. the formula is this: education, employment, savings, investing, compounded returns and ultimately financial success. There are fears and impediments along the way that can create temporary complications, but the reality is that wealth-building boils down to this simple lifetime methodical formula.

The media may trumpet stories of some making millions on a penny stock, an ambitious underdog who founded their own successful company or maybe the tiny demographic of big wealth inheritors. These are outlier, right of the bell curve examples of what very few experience. So, it may be natural to think, “I missed out!” but fear and envy are not good wealth builders, so it makes sense to focus on the elements that can and do build wealth. The salvation for most wealth builders comes with a reminder that the passage of time is an extraordinary wealth-building force.

There is no copy and paste answer for everyone, yet the basic formula holds. Building investment capital through savings is the most common way that the financially successful grow their wealth in the United States.

Let’s look at this step-by-step:

- Education Then Income: The process of building wealth begins with education. As Buffett says: “invest in yourself first.” Education gets you in the door and gets you salary. Beyond that, capitalism is disruptive, so consistent skills upgrades after basic education are important because of how capitalism works. Some take education and couple it with grit to move toward entrepreneurship – that is, start a company – which can be the best wealth-building path.

- Income Then Savings: Wage/salary income supports lifestyle for most. Living a lifestyle well within that wage/salary income stream allows the excess to be funneled into productive assets. Productive assets refer to those that have the capacity to grow in value and/or produce a stream of income. This includes marketable securities, investment real estate, bonds – anything that over long periods has historically provided positive and generally reliable returns. In this, the accumulation phase, it is ideal to minimize allocations to assets that fail to grow in value or produce income or those that require large maintenance costs.

- Savings Then Growth: Moving wage/salary income into productive assets diverts income from consumption to a nest egg of assets that can grow and produce their own income. These assets, while most often beginning at a small base, can be added to and then to compound over long periods. Compounding over time is crucial. Compounding adds returns on top of returns to create a down-the-hillside snowball effect that accelerates sizeable asset growth. During this accumulation phase, targeting returns over the inflation rate is also important to overcome long-term inflation drag…this is why growth-oriented assets should include a large allocation of productive assets.

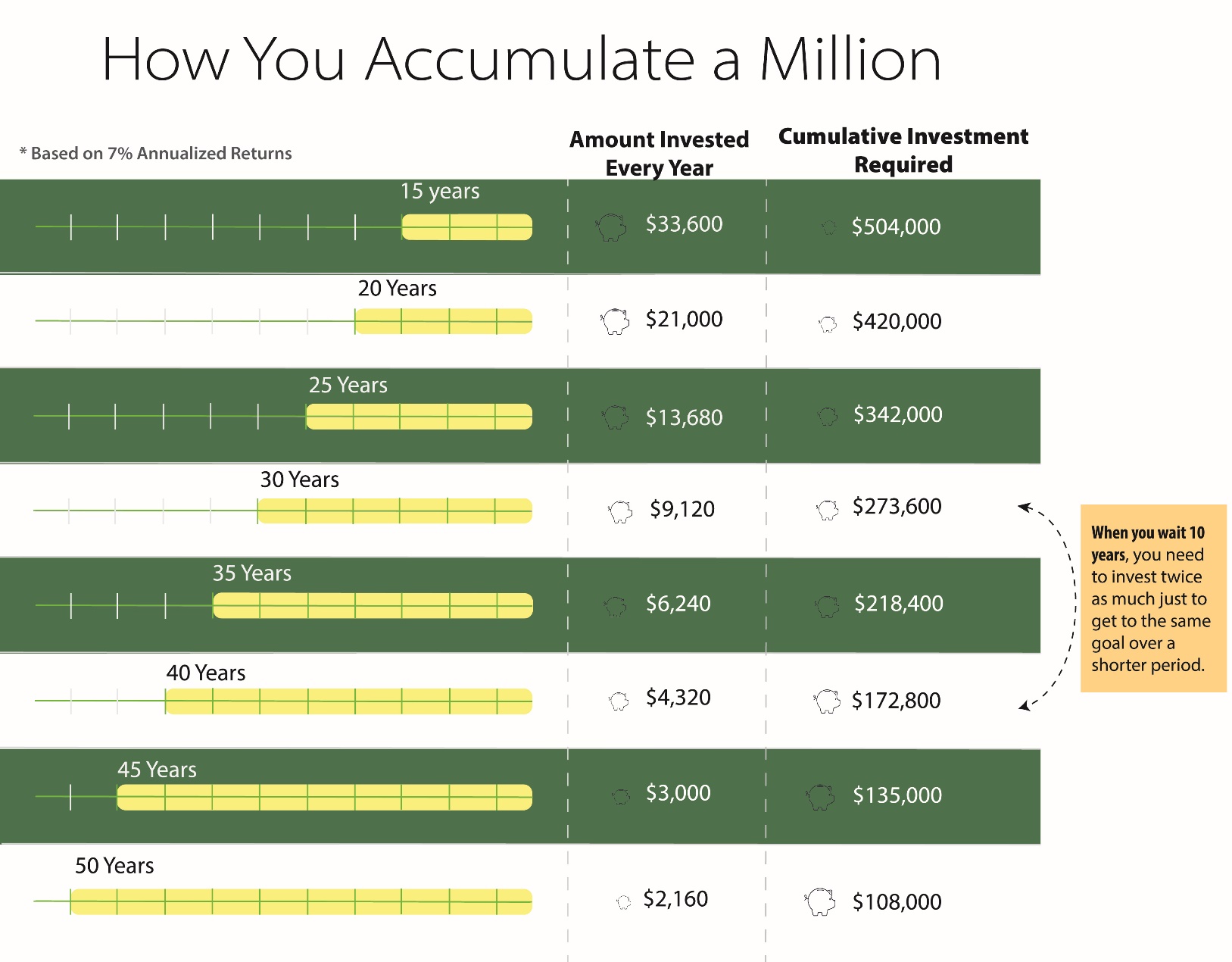

Starting savings early in life is very beneficial: cumulative investment requirements increase dramatically with late starts. It takes $33,600 annual contributions over 15 years at 7% returns starting at age fifty to reach a million by retirement at age sixty-five, but only $13,680 annually if started at age forty. The age fifty contribution requirement is 2.5 times higher than the age 40 requirement.

- Growth Then Decumulation: At some point, accumulated wealth serves some useful purpose(s). These purposes can include replacing working years earned income, passing along assets to heirs, charitable causes or further investment. The best uses are determined by those fortunate to have the capacity to decide such matters. The beauty of wealth is that it provides flexibility and freedom to decide its use.

And Ultimately Financial Success…

Asset accumulation is the equivalent of establishing a manufacturing facility to provide lifetime cash flow. Done well, long-term savings/wealth accumulation can enhance a few or many lives.

Analysis Can be Helpful: Wealth is not a hard formula; however, the numbers that make it work well for specific goals/circumstances might require some hand-holding. Experienced advisors can provide in-depth, customized analysis to confirm the direction and numbers.

Grant S. Donaldson, MS, CPA

Tudor Financial, Inc.

Please visit: https://tudorfinancial.com

Grant Donaldson has contributed to the accounting, tax and financial professions for over thirty years. He established Tudor Financial, Inc. in 1992 and continues to serve individuals, families and institutions with his experience in asset management, tax analysis, estate planning, and other financial planning needs. He is a prolific writer and researcher of investment history, strategy and risk management methodologies. He has provided hundreds of presentations to groups throughout many years of service in the financial profession. Tudor Financial, Inc. currently serves clients in over 30 states.