“Building wealth is designed for marathoners not sprinters”

Your net worth is an important concept in your personal financial arsenal of knowledge. It is crucially important because it represents a financial status measure that has a big impact on lifetime financial outcomes. Your net worth is the asset pile you accumulate to replace the cash flow of earnings from your working years.

Your net worth is an important concept in your personal financial arsenal of knowledge. It is crucially important because it represents a financial status measure that has a big impact on lifetime financial outcomes. Your net worth is the asset pile you accumulate to replace the cash flow of earnings from your working years.

When we hear about the concept of net worth, there are a few outliers. Kudos to Jeff Bezos for having a trillion-dollar net worth – but that clearly sets a lofty and unreasonable bar for the rest of the world. We hear of others with stratospheric net worths, but they represent a very small proportion of U.S. net worth demographics. With good money practices, most income earners can grow their net worth to healthy levels over time.

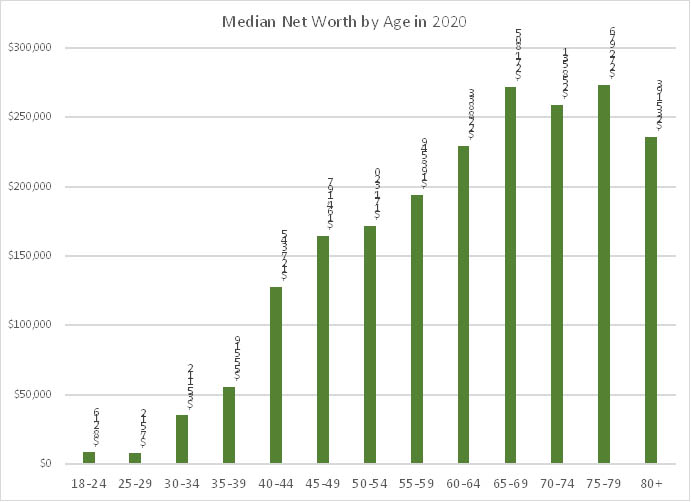

The existing status of U.S. wealth/net worth is generally not a rosy one. The reality is that the net worth of most Americans cannot sustain a decades-long retirement. In 2020 the median (half above and below) net worth for all households in the United States, according to the Federal Reserve, was $121,411.(1) The picture is a bit better for those approaching retirement – median net worth for 60-64 year olds was $229,000(1). With some effort and guidance, you can do better.

At some point in your financial life cycle it is common that you evolve from adding to net worth from earnings to then tapping into it. The variables that go into determining how much to add during the accumulation years, when to convert to drawing from net worth and calculating how much to draw from your net worth requires some analysis. Your mission is to match or exceed the net worth that fully funds your unique retirement goals.

The most common way that people build their net worth is through savings from earnings. Inherited wealth is not a reliable or common way to build substantial net worth. Better to fend for yourself. Consistent salary or business earnings and the passage of time are extraordinarily reliable ways to build wealth and net worth.

Time is a heavily weighted factor in building net worth: 90% of Warren Buffett’s net worth came after he reached age 65(2) – as he reaches the decade of his 90’s he has had the benefit of compounding and time.

How to calculate it: To calculate your net worth, add up your assets – bank account balances, retirement plans, non-retirement investment accounts, annuities, investment and residential property, business interests and any other valuable assets and subtract from that total your outstanding loans (mortgages, credit card debt, lines of credit). What is left is net worth. To stress test your number, subtract out the value of your home and mortgage.

In the United States, larger net worths are much more prevalent now as inflation chips away at the difficulty of achieving what was once an uncommon financial status: millionaire. 11% of US households have a net worth above $1,000,000.00.(1) Who would have thought that one-tenth of U.S. households are millionaire households? Qualifying in the top 1% requires a net worth above $10,000,000(1). See the following table for net worth brackets by age:

(Source: The Federal Reserve)

Each year, inflation chips away at net worth, which suggests the importance of growing assets and net worth above that financial drag.

A crucial factor to remember is that time is your friend when building net worth. There is little need to jazz up returns or take large risks if your net worth assets are compounding at a healthy clip for long periods of time.

(1) https://dqydj.com/average-median-top-net-worth-percentiles/ (2) The Psychology of Money, Morgan Hausel

Grant S. Donaldson, MS, CPA

Tudor Financial, Inc.

Please visit: https://tudorfinancial.com

Grant Donaldson has contributed to the accounting, tax and financial professions for over thirty years. He established Tudor Financial, Inc. in 1992 and continues to serve individuals, families and institutions with his experience in asset management, tax analysis, estate planning, and other financial planning needs. He is a prolific writer and researcher of investment history, strategy and risk management methodologies. He has provided hundreds of presentations to groups throughout many years of service in the financial profession. Tudor Financial, Inc. currently serves clients in over 30 states.