Americans Save More When Fearful

Savings rates ebb and flow over time. We know this because government tracks this phenomenon…

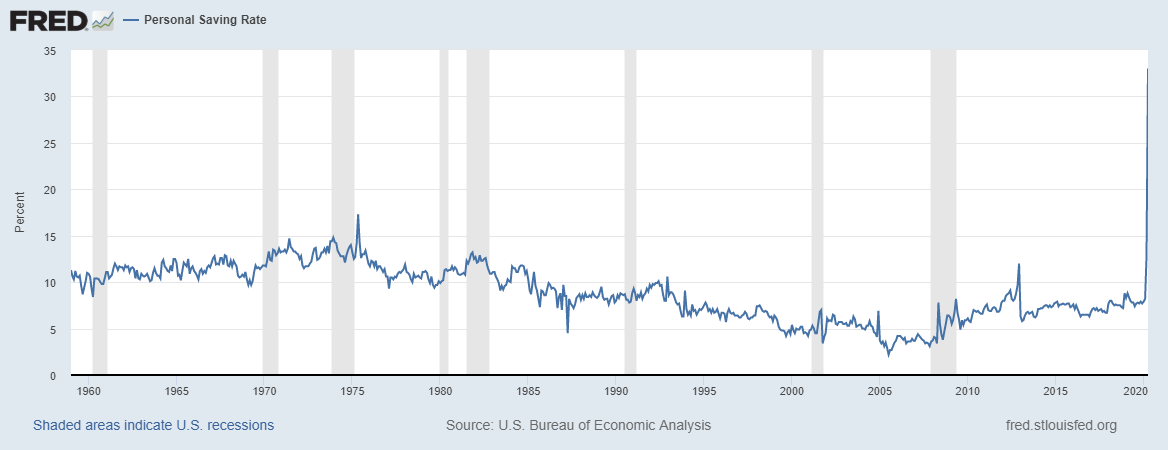

The FRED (Federal Reserve Economic Data) graph/chart below shows U.S. personal savings rate trends from 1960 to 2020. What becomes apparent after a little analysis is that there is a clear correlation between financial crises and savings rates. In other words, financial crises nearly always inspire Americans to hunker down, hoard cash and think about their financial future. Fear and uncertainty are powerful motivators.

In the 1960’s (prior to 401(k) accounts and IRA’s), Americans were saving at a healthy 10% clip. The primary sources of retirement income at the time were pensions (but certainly not available from all employers) and a small level of social security. Savings were the additional buffer. Bank accounts were common savings vehicles – but interest rates were a little higher back then – around 4%(1). American personal savings rates have largely trended down since the 1960’s, but savings spikes have occurred over time. So why do savings rates spike?

You can see in the mid 1970’s that savings rates jumped after a severe early ‘70’s economic crisis. The Arab oil embargo was a catalyst for severe economic disruption and soaring unemployment in the early 1970’s. Combine the oil embargo with a stock bear market decline of over 40%(2) and you have ongoing rampant fear among American consumers. So, there you go – the ingredient for a savings spike.

There were several modest savings spikes in the chart’s sixty-year history, but two substantial surges occurred more recently.

More Recent Scariness

A recent savings spike occurred in the aftermath of the 2007 – 2009 Great Recession. This was a hugely fearful time of financial market declines, real estate price implosions and high unemployment for many Americans and folks worldwide. This financial calamity inspired cash hoarding and a U.S. savings rate that briefly shot back up to 12% in 2012.

Very recently, a huge second savings spike is occurring during the 2020 COVID scare. This scary time includes extraordinary increases in unemployment and unprecedented economic shutdown. The fear of government-mandated business closures propelled the personal savings rate to 13-14% in April/May 2020. And then that same extraordinary savings spike moved exponentially higher to over 30% for a period of several weeks.

It Goes the Other Way Too – A Low Ebb in Savings

We also see where financial comfort and confidence is clearly related to diminished savings rates. In the mid-2000’s, after many years of bull market and an extended period of low unemployment, the savings rate plummeted to a sixty year low of 2.2%. It did not help that there was also rampant speculation in real estate at the time. Savings was diverted into overpriced and speculative residential real estate in the mid-2000’s – a sign of reckless overconfidence at the time.

What Does This All Mean?

It could be that too much financial comfort is detrimental to our financial welfare. Financial confidence colors our perception of the certainty of our future – creating more confidence than justified. The downside to roaring investment markets and solid employment is that the resulting financial comfort makes savings a secondary thought – and this undermines the need to properly prepare for financially challenging periods and ultimately a secure retirement.

What to Do?

It may pay to be a little fearful. Too much certainty creates too much comfort. Planning for the future requires an itch, a level of discomfort, to make provision for that future.

The autumn squirrel gathering nuts is driven subliminally by instinct, very important behavior to avoid freezing to death mid-winter. Tapping into our natural fears (even during times of prosperity) may help spur us on to greater financial security.

Grant S. Donaldson, MS, CPA

Tudor Financial, Inc.

Grant Donaldson has contributed to the accounting, tax and financial professions for over thirty years. He established Tudor Financial, Inc. in 1992 and continues to serve individuals, families and institutions with his experience in asset management, tax analysis, estate planning, and other financial planning needs. He is a prolific writer and researcher of investment history, strategy and risk management methodologies. He has provided hundreds of presentations to groups throughout many years of service in the financial profession. Tudor Financial, Inc. currently serves a record number of clients and provides management for a record level of client assets.

Please visit: https://tudorfinancial.com

(1) macrotrends.net (2) Barrons.com